.png)

.png)

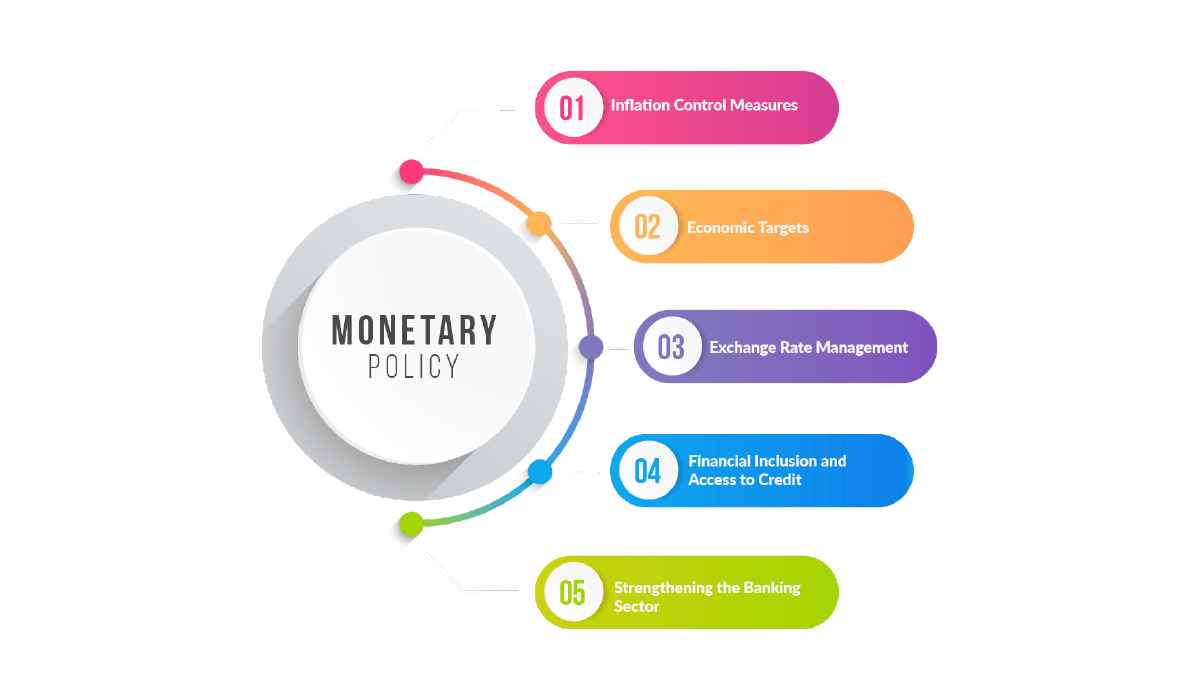

The Nepal Rastra Bank (NRB) has unveiled its Monetary Policy for FY 2081/82, providing a strategic framework aimed at ensuring economic stability, driving growth, and enhancing financial inclusion. This policy is crucial for navigating Nepal's economic landscape. Below is a comprehensive overview of the policy and its implications.

.jpg)

The NRB’s policy for FY 2081/82 focuses on the following key objectives:

These goals are integral to creating a stable and prosperous economic environment.

Inflation control is central to the policy, with a target range of 5% this year. Key measures include:

These measures are designed to keep prices stable and preserve purchasing power.

The policy sets out several important targets:

These targets aim to balance economic stability with growth and development.

To support international trade and investment, the NRB plans to:

The NRB is focused on improving financial inclusion through:

These initiatives aim to integrate more people into the financial system.

Explore Saral Banking Sewa to compare loan interest rate or to find out your credit card eligibility.

Key measures to fortify the banking sector include:

Key Provisions for Banks:

Reduced Provisioning Requirement for Banks:

.jpg)

Visit the Saral Banking Sewa blog page to discover more about Smart Savings Made Simple: How Saral Banking Sewa Can Help Secure Your Financial Future

The central bank is prioritizing the microfinance sector with several measures:

To boost investment security and encourage private equity and venture capital (PEVC):

The NRB is advocating for:

The policy includes provisions to stimulate investment and growth:

Additional Updates:

Visit the Saral Banking Sewa blog page to discover more about “Decoding Your Money Mind: How to Outsmart Yourself for Financial Success”

The policy tackles key challenges with targeted measures:

.jpg)

Recent updates include:

The NRB’s Monetary Policy for FY 2081/82 is a forward-looking framework designed to guide Nepal towards economic stability, growth, and financial inclusion. By focusing on key areas such as inflation control, exchange rate management, financial inclusion, and digital transformation, the policy aims to foster a conducive environment for sustainable development.

Stay updated on these changes and their potential impacts by following the latest updates from the Nepal Rastra Bank.

For further reading, check out the official press release and this article on the new monetary policy from Ekantipur.

Explore financial solutions with Saral Banking Sewa today.

Sign up to discover Saral Banking Sewa